Here are Most Affordable Counties for First-time Buyers in Ireland

Most Affordable Places for First-time Buyers in Ireland!

For many, saving for a deposit and selecting a place to call home mark the initial steps towards property ownership. In an effort to illuminate the most affordable regions for purchasing a house in Ireland, we have compiled an affordability index which considers a myriad of factors. So, let’s begin!

(Also read Boojum is Opening in Tallaght Next Week.)

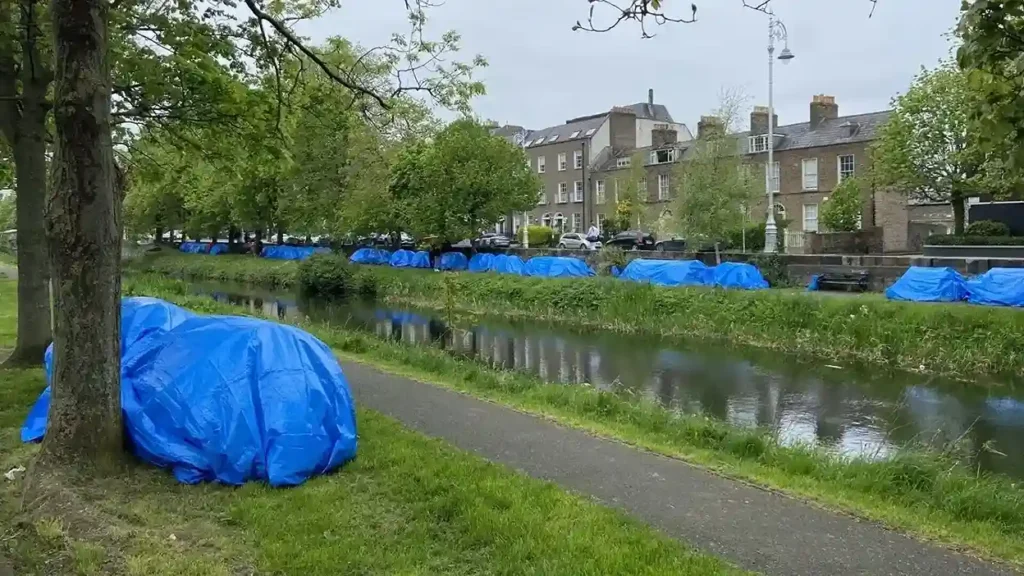

Understanding Ireland’s Housing Situation

In January 2024, the average selling price of a semi-detached house with three bedrooms was €305,259, according to the Real Estate Alliance (REA). Notably, first-time buyers comprised 59% of buyers nationally and a staggering 80% in commuter counties. Echoing this, the Central Statistics Office (CSO) reported a median home purchase price of €330,000 in the 12 months leading up to January 2024.

What is the Significance of the Affordability Index?

While various agencies furnish data on regional house prices and market trends, discrepancies exist across surveys, often neglecting buyer specifics such as income and property type. Hence, affordability index strives to present a more nuanced perspective by factoring in variables like income, savings, and geographical location.

Key Components of the Affordability Index

This index delves into borrowing limits, deposit prerequisites, and the advantages of joint property acquisition. In Ireland, mortgage lenders typically mandate a minimum 10% deposit, though factors like income and location can influence the duration required to amass such funds.

| Position | County | Property Price | Median Joint Income | Income to House Price | Years to Save |

| 1 | Leitrim | €184,000 | €75,408 | 2/5 | 2.5 |

| 2 | Longford | €179,500 | €72,356 | 2/5 | 2.6 |

| 3 | Roscommon | €201,500 | €78,096 | 2/5 | 2.7 |

| 4 | Sligo | €210,000 | €78,886 | 3/8 | 2.8 |

| 5 | Mayo | €210,500 | €75,496 | 3/8 | 2.9 |

Spotlight on Joint Buyers

Pooling incomes can bolster borrowing capacities and expedite deposit accumulation for joint buyers. Counties like Leitrim, Longford, and Roscommon emerge as prime options for affordability, whereas Dublin and its environs pose challenges despite joint purchasing possibilities.

Insight into Dublin

Dublin and its peripheries present the least affordable prospects for both sole and joint buyers. Despite the allure of high salaries, property prices often surpass buyers’ financial thresholds, necessitating substantial deposits.

Buying an Apartment Alone

Affordable apartment purchases may not necessarily align with regions boasting the lowest property prices. Instead, locales offering comparatively higher incomes relative to property costs prove more attractive. Counties such as Roscommon and Longford shine as top picks for sole buyers, while coastal areas like Dún Laoghaire and Wicklow pose formidable hurdles due to elevated prices.

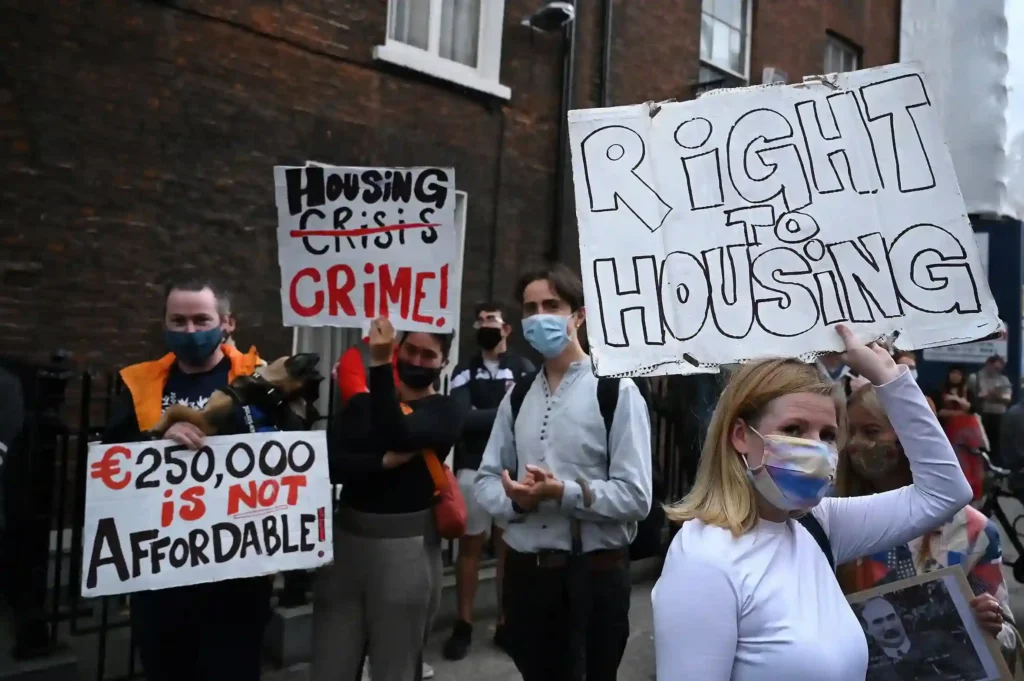

Government Schemes for First-Time Buyers in Ireland

Various governmental initiatives, including the First Home Scheme, Help to Buy Scheme, Local Authority Affordable Purchase Scheme, Mortgage Allowance Scheme, and Local Authority Home Loan, aim to facilitate homeownership for first-time buyers in Ireland through financial aid and incentives.

Challenges in New Build Availability

While pivotal for many first-time buyers, the correlation between new build availability and soaring house prices presents a conundrum. Regions boasting exorbitant house prices often attract a disproportionate share of new housing developments, placing rural home buyers at a disadvantage.

In essence, while affordability remains a pressing concern for first-time buyers in Ireland, a nuanced understanding of location, income, and available governmental schemes can smooth the path to homeownership.

LATEST NEWS

DISCOVER MORE