After Market Surge, Homes For Sale in Ireland Hit A 17 Year Low, Daft.ie Report

Due to the continued shortage of Homes for sale in Ireland asking prices for properties increased 1.8% nationwide between January and the end of March compared to the preceding three months.

(Also read Heavy Rain Warning and Possible Flooding in Western Ireland.)

The latest Daft.ie House Price Report reveals a significant uptick in housing prices, with the advertised price for a house or apartment reaching €326,469 nationally. This marks a 5.8% increase from the same period at the start of 2023, more than doubling the inflation rate in just a year.

Rising Prices Nationwide, Supply Strain Continues

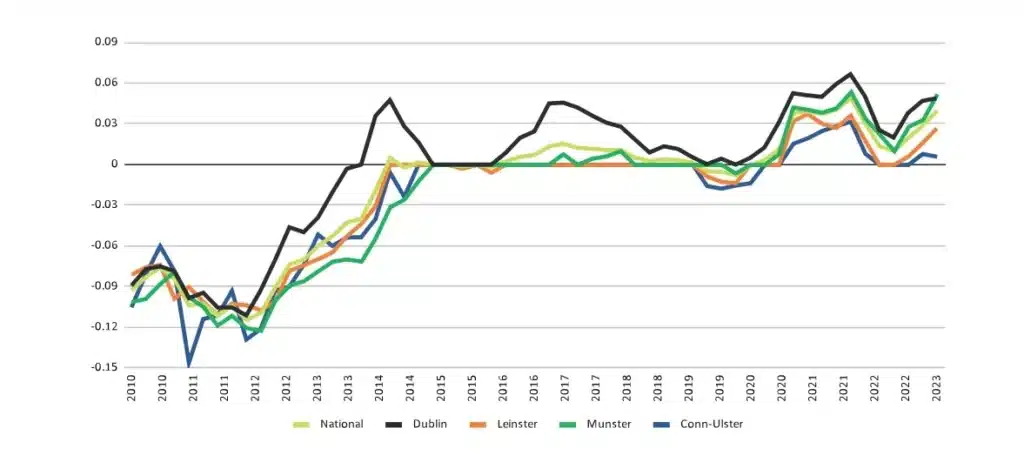

According to the report, prices are rising in year-on-year terms in 51 out of 54 markets covered, with declines only observed in Dublin 2, Dublin 4, and Dublin 6. Economist Ronan Lyons attributes these trends to an overall shortage of supply, compounded by the impact of Central Bank rules.

Historic Low in Homes for sale in Ireland

The number of homes for sale in Ireland on Daft as of March 1st stood at below 10,500, marking a 24% decrease year-on-year and hitting a new all-time low. This scarcity extends across all major regions, indicating a widespread shortage in available properties.

Supply Crunch in Second-Hand Market

Mr. Lyons highlights the tight conditions in the second-hand market since the onset of Covid-19, with availability plummeting well below pre-pandemic levels. Although home construction has increased steadily, interest rate hikes have impeded the recovery of the second-hand market.

Regional Disparities in Price Increases

While Dublin experienced a 3.2% increase in prices compared to the previous year, regional cities like Waterford and Limerick saw hikes exceeding 10%. Prices in Munster and Connacht-Ulster also surged significantly, indicating a broader regional impact of the housing market dynamics.

Implications of Central Bank Policies

Lyons points out that Central Bank mortgage rules have inadvertently shifted housing demand away from expensive areas like Dublin, potentially stretching household finances due to commuting costs. This underscores the complex interplay between policy measures and housing market dynamics.

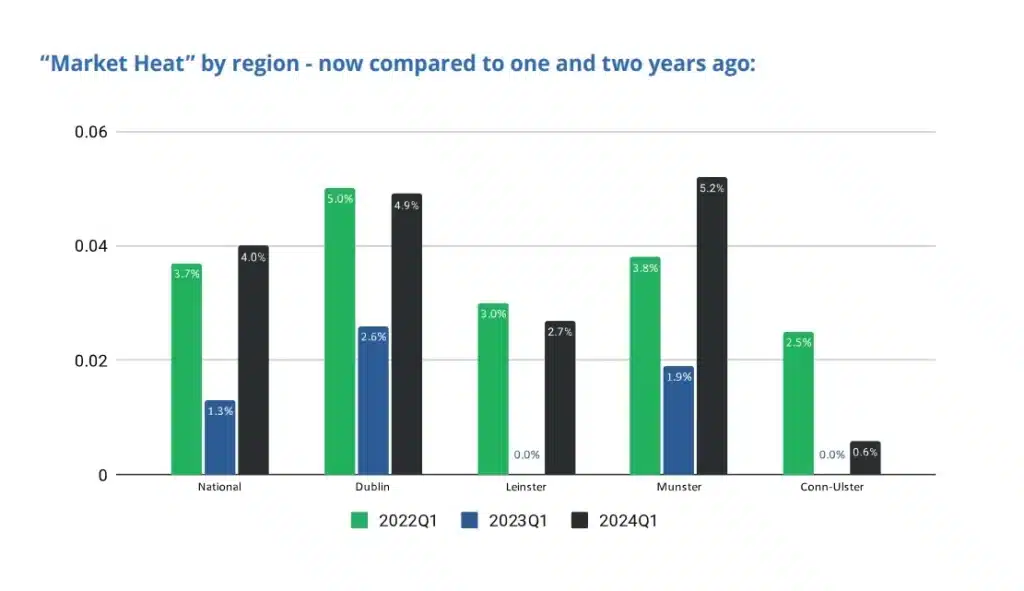

Transaction Prices Exceed Listings

The report also reveals that the typical transaction price in the fourth quarter of 2023 was 4% above the listed price nationwide. This represents a notable increase from previous years, indicating heightened competition and buyer willingness to pay above asking prices.

The latest Daft.ie House Price Report paints a picture of a housing market characterised by soaring prices, dwindling supply, and complex regional dynamics, with implications for both prospective buyers and policymakers alike.

LATEST NEWS

DISCOVER MORE